For the second time in the last two years, trading card giant Collectors has consolidated the grading and authentication industry by acquiring a competitor to the company’s premier brand, PSA.

Collectors began its consolidation of the market in February 2024 when it acquired rival grader SGC.

The company doubled down on the strategy Monday when it reached an agreement to acquire Beckett’s grading services, magazines and price guides.

According to Collectors CEO Nat Turner, Beckett will continue to operate independently as its own brand under the Collectors umbrella.

Including Beckett, Collectors now owns three of the four most popular grading and authentication services, based on submission volume. CGC Cards, which is owned by Certified Collectibles Group, is the lone remaining independent authenticator of the four.

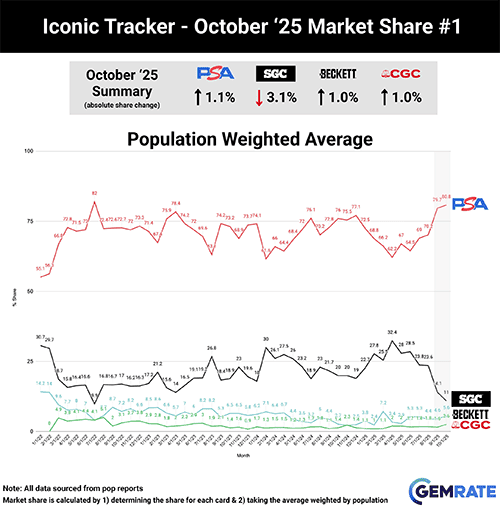

According to research from third-party tracker GemRate, PSA has accounted for 71% of the grading industry’s business so far in 2025 with more than 18.3 million graded cards. Combined with SGC (1.4 million) and Beckett (789k), Collectors now owns 79% of the industry’s overall grading business.

????GemRate | 1H 2025 Grading Recap

— GemRate (@gemrate) July 3, 2025

Total grading activity across the major graders was ⬆25% YoY in the first half of 2025. Over 12.4 million cards were graded.

Market Share Breakdown for 1H 2025

TOTAL

-- PSA 72%, CGC 17%, SGC 8%, Beckett 3%

SPORTS

-- PSA 73%, CGC 7%, SGC 18%,… pic.twitter.com/WTtlLqWvl1

CGC Cards has graded more than 3.85 million cards in 2025 for an 18% market share. TAG has graded nearly 416,000 for roughly 2% of the market.

When the scope of the market is narrowed to high-end cards and best-sellers, various data points show Collectors and its brands have even more influence with a near-exclusive grip on the industry’s most important cards.

According to Card Ladder’s public records, Collectors brands now account for 91 of the 100 most expensive card sales of all time. Of those sales, 49 were graded by PSA, 32 by BGS, 10 by SGC and eight were in raw condition.

The lone card graded by a non-Collectors brand in the top 100 is a 1993 Magic: The Gathering Limited Edition Alpha Rare Black Lotus CGC 10 Pristine, which sold for $3 million privately in 2024.

Of the 100 most expensive cards sold so far in 2025, according to Card Ladder’s records, Collectors brands accounted for 92, including 72 from PSA alone. Eight of the top 100 sales were cards in raw condition.

Though many of the most important sports and trading cards of all time have landed among the industry’s highest sales, expensive doesn’t always equal important or influential.

GemRate’s Iconic Tracker, which includes cards featured on the PWCC Iconic 100 list, follows cards deemed important for their impact and influence on collecting as much as their secondary-market value.

Since GemRate began tracking grading data in January 2022, PSA has never graded fewer than 70% of cards featured on the Iconic 100 in a single year.

In total, there are more than 1.5 million graded examples in existence of cards listed on the Iconic 100, including more than 1 million graded by PSA. Combined with cards graded all-time by Beckett and SGC, Collectors brands now account for 98.9% of graded examples on the list.

As of Tuesday, cards on the Iconic 100 have been graded by CGC a total of 16,179 times for a 1.1% market share among the four major authenticators.

It’s worth noting the Iconic 100 primarily features sports cards, with non-sports and TCG represented just four times. Though this underrepresents CGC’s impact in the non-sports and TCG space — particularly with Pokémon — it does illustrate the delta between Collectors brands and CGC for sports cards.

Though Collectors has a powerful hold over high-end and influential cards, the majority of the sports and trading card market features lower-priced examples.

An analysis by cllct of the 10,000 most transacted graded cards tracked by Market Movers over the last 365 days found Collectors holds a similarly powerful position among everyday hobbyists at the low end of the market.

Of those 10,000 cards, which ranged from a high of roughly 4,200 sales over the last year to a low of a little more than 50, more than 9,200 were graded by PSA.

Overall, CGC has graded fewer than 500 of those 10,000 best-sellers, while BGS and SGC combine for fewer than 250.

Descending from the top-ranked 2023 Pokémon Japanese Triple Beat Magikarp Art Rare PSA 10, it takes 260 cards to find one that isn’t holdered by PSA. Of those 10,000, a BGS-graded card doesn’t appear until card No. 973, and an SGC-graded card doesn’t show up until No. 1,567.

On its own, PSA has graded more than 92% of those 10,000 best-sellers. Combined with SGC and BGS, the Collectors umbrella rises to more than 95%.

Roughly 260 of the cards among Market Movers’ 10,000 best-sellers have averaged $1,000 or more over the last 365 days, while a little more than 7,000 have averaged less than $100. Collectors’ share of this market doesn’t quite match its position among Iconic 100 cards, but it does represent a significant share for cards purchased by regular, everyday hobbyists.

The scale of the money spent by the average hobbyist on Collectors brands, particularly PSA, is staggering when analyzing secondary-market sales from online marketplace eBay. According to research from GemRate, hobbyists have spent more than $1.186 billion buying graded trading cards on eBay in the first 11 months of 2025.

Of that total, more than $968 million was spent on PSA-graded cards, including more than $624 million on sports cards, representing an 82% share of the graded card market on the platform.

Combined with BGS’ more than $119 million in sales and SGC’s more than $53 million, Collectors brands make up roughly 96% of the graded card market on eBay. CGC’s more than $44 million accounts for roughly 4% of the market.

In terms of overall card submissions, the addition of BGS and SGC within the last two years added a small but not inconsequential amount of market share for Collectors’ grading business.

For many hobbyists, Collectors owning 75% of the major authentication brands is a more important number than the company taking in nearly 80% of the industry’s submissions.

The most important number, however, remains the total number of transactions for those graded cards, and that number doesn’t actually change much when Collectors already owned the runaway favorite.

Want more stories like this? Subscribe to the cllct newsletter and follow cllct on X and Instagram.

Ben Burrows is a reporter and editor for cllct, the premier company for collectible culture. He was previously the collectibles editor at Sports Illustrated. You can follow him on X and Instagram @benmburrows.